With the emergence of the Connected Car, ADAS, and Self-Driving Cars, OEMs are asking one important question: How do we solve the paradox of a piece of hardware that will exist for 10 years in an industry where the preferred features and technologies of our users evolve every 3 years? According to SimilarWeb, nearly 60% of web traffic is coming from mobile browsers, so the odds are that you are holding the answer in your hand right now.

Getting from Here to There

IHS Automotive analysts project that the connected car will accommodate between 85-95% of Light Vehicles sales by 2025 in Japan, US, and Western Europe. The BRIC countries are trailing behind with a projected adoption rate of 55% in China and 20% in India.

Simple core ECUs with a few thousand lines of code are quickly becoming a relic of the past and new cars coming onto the road by 2025 will have millions of lines of code. As TCUs and ECUs increase in adoption and complexity, major concerns over security and updatability are inevitable.

Future proofing the software against vulnerabilities and being able to supply contents from the cloud will make Over-the-Air (OTA) updates a common feature for everything from infotainment apps and software to the OS itself, but this is only the beginning.

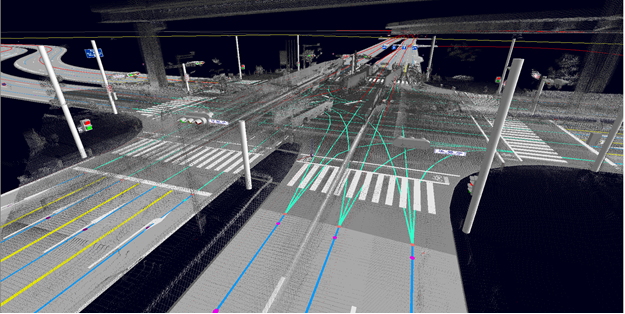

Within a few generations, bi-directional OTA will be common place to provide real-time creation of content on a massive scale. One such implementation will be self-generated 3D HD Maps from onboard autonomous drive and ADAS sensors to the cloud.

ZENRIN Japan (a world leader in map data) provided the below images of some concepts illustrating the high-level of detail these advanced maps will provide from the cloud to the autonomous drive cars in incremental updates using OTA:

But OTA Only Solves Half the Problem

While OTA will be instrumental towards enabling the software driven in-car experience, the hardware in the car cannot be upgraded so easily. With technologies like 5G and femtocell expanding the capabilities of service delivery and content offerings, it is abundantly clear that – even with OTA – Automotive OEMs will not be able to quickly harness disruptive innovations at a hardware level. This hardware-to-software gap is projected to expand, and when combined with rapid breakthroughs in machine learning, consumers will be left facing a dilemma.

With the decision of making a huge investment in a new vehicle when the next big thing is just right around the corner, buyer hesitation and purchase regret will increase. Projections from Diana T. Kurylko at Automotive News indicate that Millennials are projected to encompass 40% of all new vehicle sales by 2020 – and perhaps more than 60% by 2025 at current rates. The smartphone is essential to Millennials and could be the key to bridging the hardware gap between driver needs and automobile life cycles by utilizing the smartphone’s hardware to act as the brain of the connected car and the greater Internet of Things (IoT) ecosystem.

Smartphone life cycles are in sync with technological breakthroughs and can offer an adaptable hardware platform that is easily interfaceable with the interconnected IoT ecosystem of tomorrow.